Managing finances might not be the most enjoyable aspect of running your startup, but it is definitely one of the most important.

If you don’t have the budget to hire your own accounting team, you might want to consider using a few of the following apps to help keep you on top of your finances. They will free up time for you to focus on strategies to take your startup to the next level.

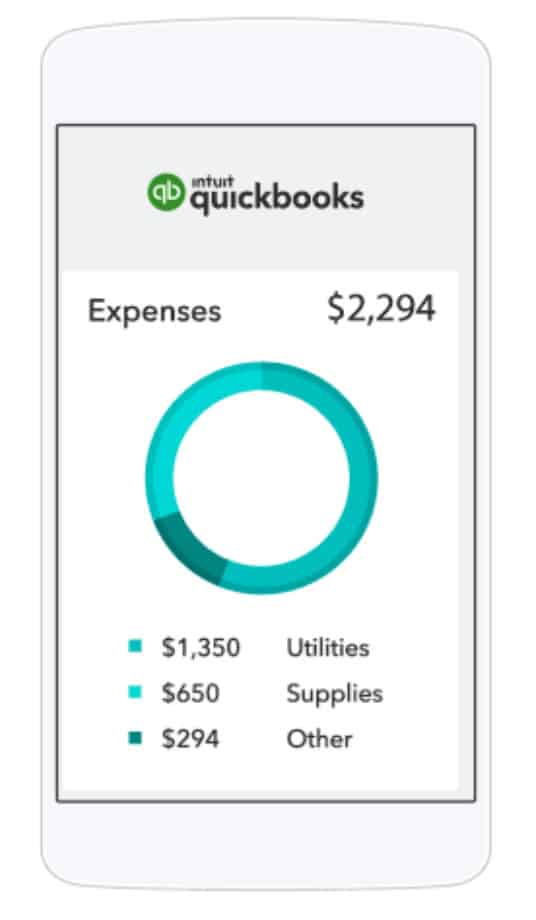

1. Quickbooks

Quickbooks accounting software helps small businesses organize their expenses, control cash flows, track receipts, create custom invoices with a pay now button for one click payments, and the ability to instantly create reports. Their goal is to automate as much as they can so you spend less time on accounting, giving you time to focus on your other priorities.

Quickbooks allows you to take care of your financial business from any device, making it great for those of you who like to work from anywhere and on any device. Other added features include filing your payroll taxes and uploading data from all your accounts seamlessly. Quickbooks also makes regular updates to its dashboard, helping create an intuitive user experience.

Quickbooks online pricing ranges from $10-$28/month depending on your needs. The PRO 2017 desktop version is $199.95/month. They also offer a free 30-day trial for those of you who want to test it out.

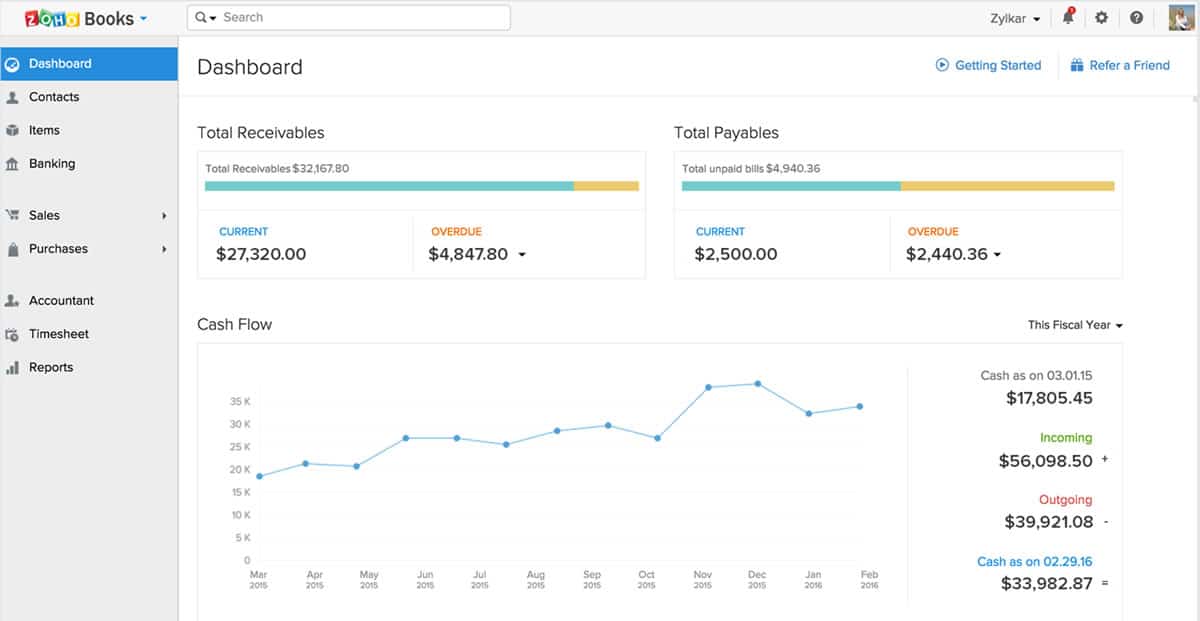

2. Zoho Books

Zoho is an accounting software platform designed specially for small businesses. You can create and send invoices, track expenses, create reports, and sync bank accounts all from a mobile device. Zoho helps automate financial tasks, freeing up time for you to focus your attention on growing your business.

For those of you dealing with inventory, Zoho offers a tool to help manage it easily. The app automatically updates the quantity and value of the items as they are sold and/or replenished, allowing you to know exactly what you have in stock and adjust if needed. You can also set notifications to purchase goods when their stock numbers fall to a certain level.

Zoho Books includes a few other appealing features, including a tax management tool to help manage deductions and exemptions, the ability to run numerous businesses on one account, and support for multiple currencies and languages.

Zoho offers a 14-day free trial. Their pricing plans range from $9/month to $29/month.

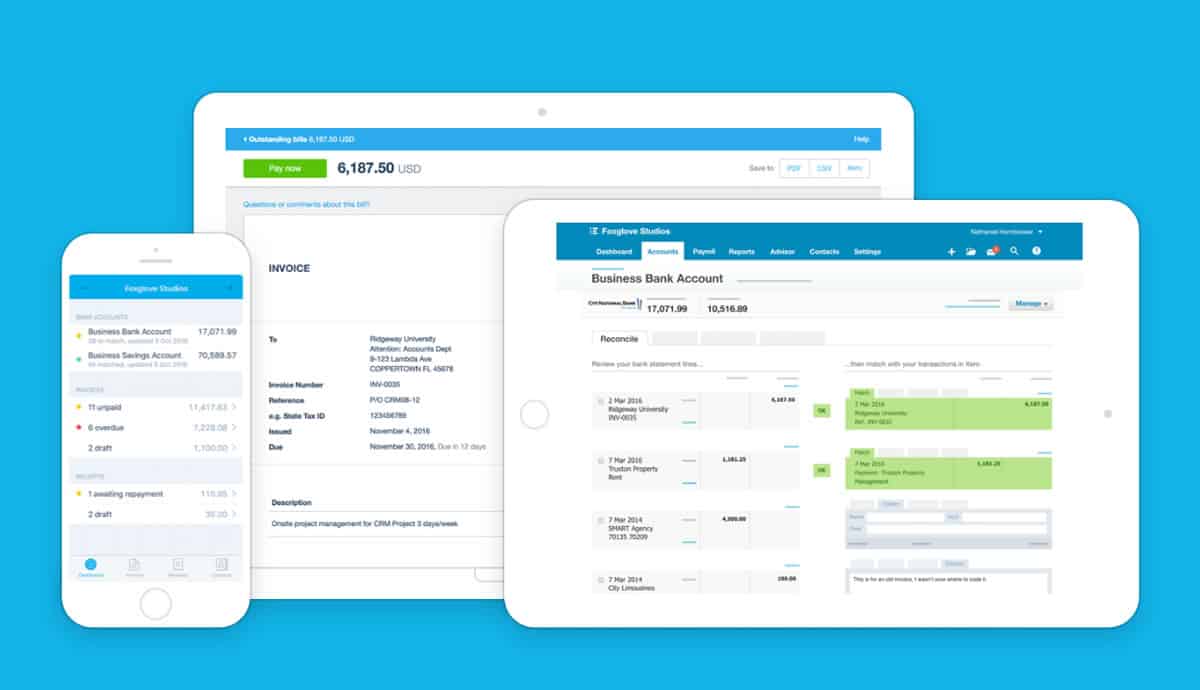

3. Xero

Xero is accounting software for startups that helps you check your cash flow on the run and share critical financial data with key stakeholders quickly and easily. It is integrated with more than 400 add-on solutions that you can pick and choose from, depending on your needs, from inventory management, to time tracking, and invoicing.

Xero provides you with the time-saving financial tools you need to save you time. Xero also offers 24/7 customer support.

They have 6-month introductory offers ranging from $6.30/month to $49/month, depending on your needs and budget.

4. Gusto

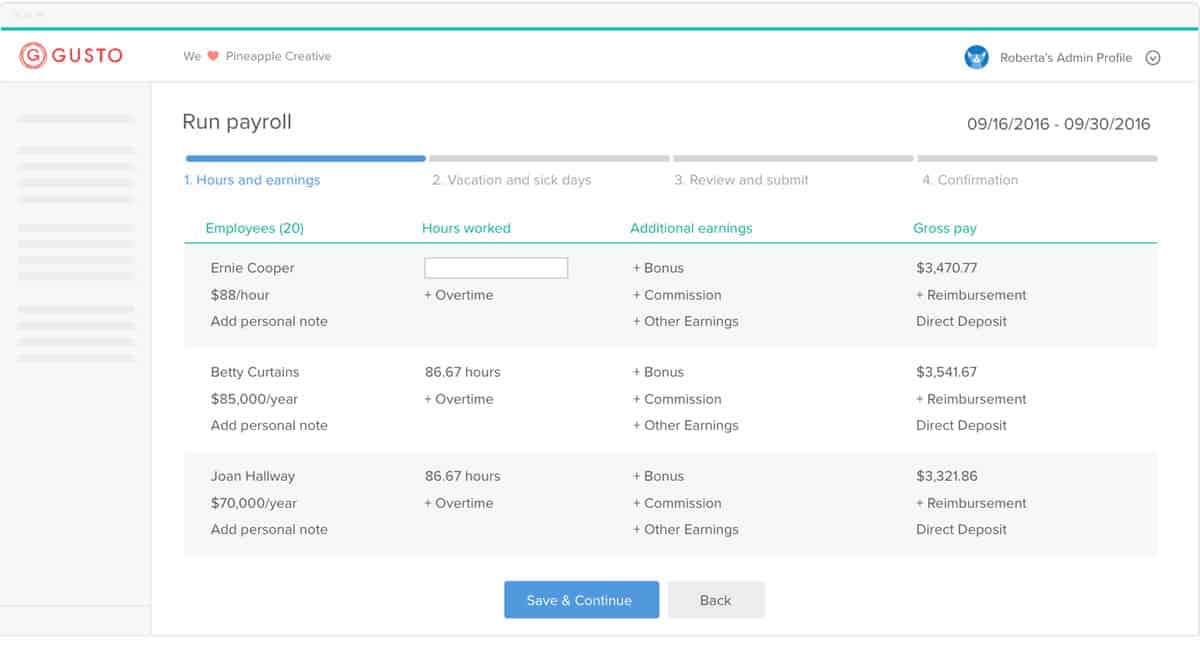

Gusto automates all of your human resources tasks in one place, from payroll to benefits. Gusto’s founder Josh Reeves says that Gusto was designed with a “people-first mentality,” letting employers write personalized notes on paychecks and sending new hires welcome messages on their first day.

Gusto allows you to customize services based on your needs. You choose how often your team gets paid and Gusto handles all the rest, from tax filings, paystubs and W2s—and it’s all done automatically. It also helps set up and manage 401k plans and health benefits. In short, Gusto puts all your HR needs in one intuitive place, making it easy to manage while giving you time to focus on your other priorities.

Gusto offers one pricing plan for payroll and benefits. It is $39/month plus an additional $6 per person.

5. Square

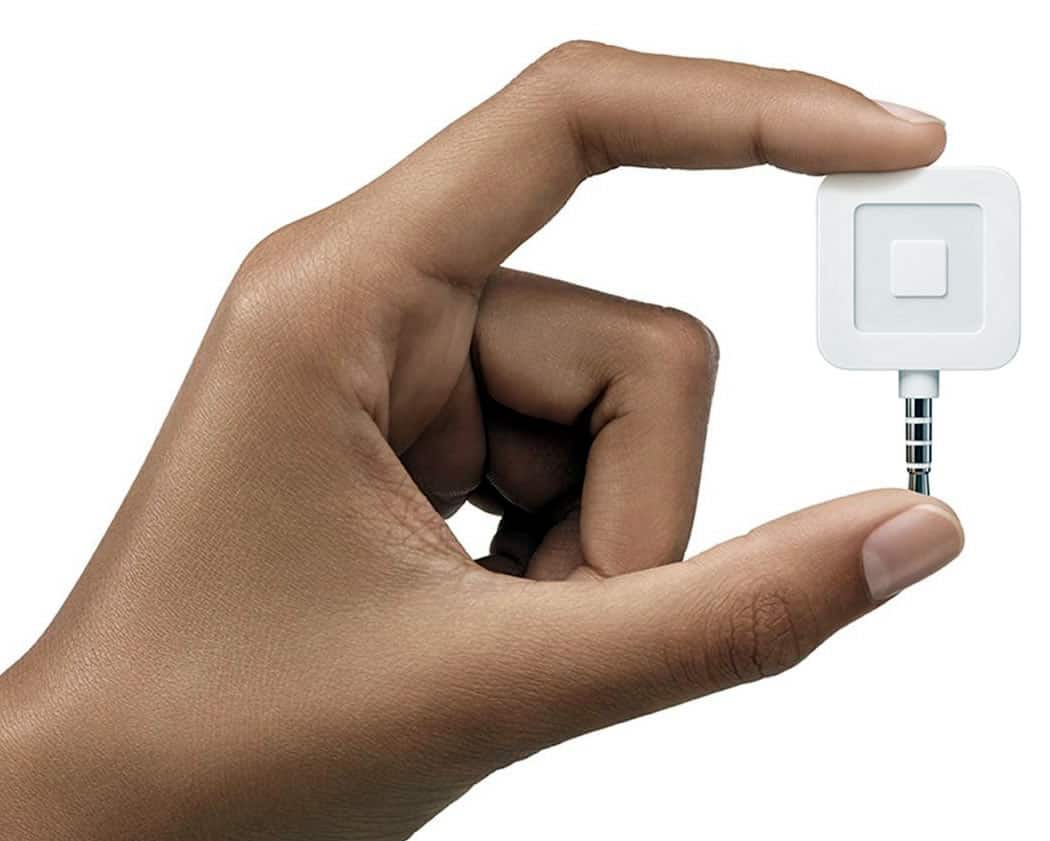

We all know how Square changed the way small businesses accepts payments from anywhere with its magstripe credit card reader. Square also has full-stack capabilities from invoicing, the option to set up an e-commerce store, an appointment booking site, and inventory management to help companies of all sizes.

Square also has a lending arm, Square Capital, to help take promising new companies to the next level.

Signing up for Square is free. After signing up you will receive your free magstripe reader in the mail. Find out more to find out more about their pricing information.

6. Expense Bot

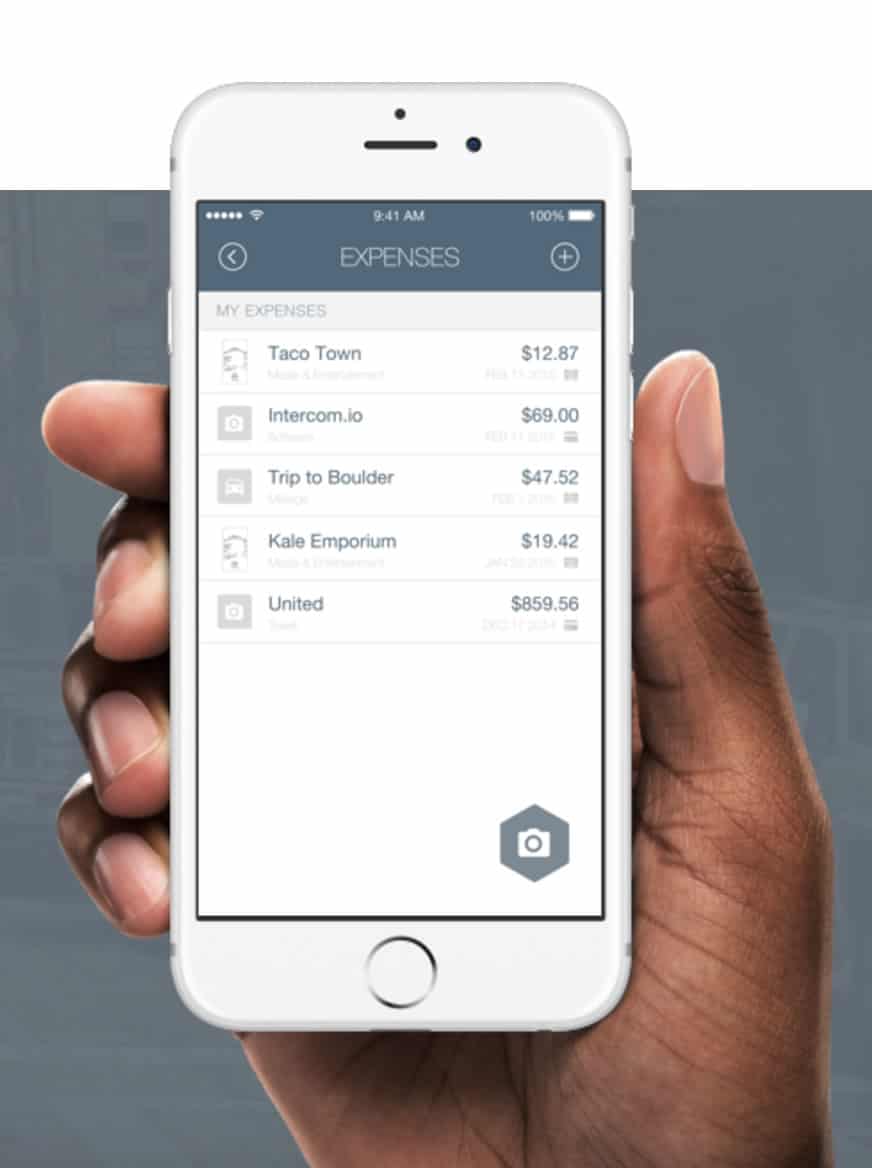

ExpenseBot is a great solution to cut time on expense reporting. They claim that they can save your team 80% of their time spent on reporting.

ExpenseBot integrates with your team’s credit cards, email, mobile devices, and calendars to learn how they spend their money and automatically tracks, categorizes and adds expenses to generate reports. Employees can take pictures of their receipts and ExpenseBot automatically enters the date, who the receipt is from, and amount. There is also a very intuitive tool to track mileage and distances for those on your team that travel.

ExpenseBot is $99/month. They also offer discounted pricing plans for non-profit organizations.

7. OnDeck

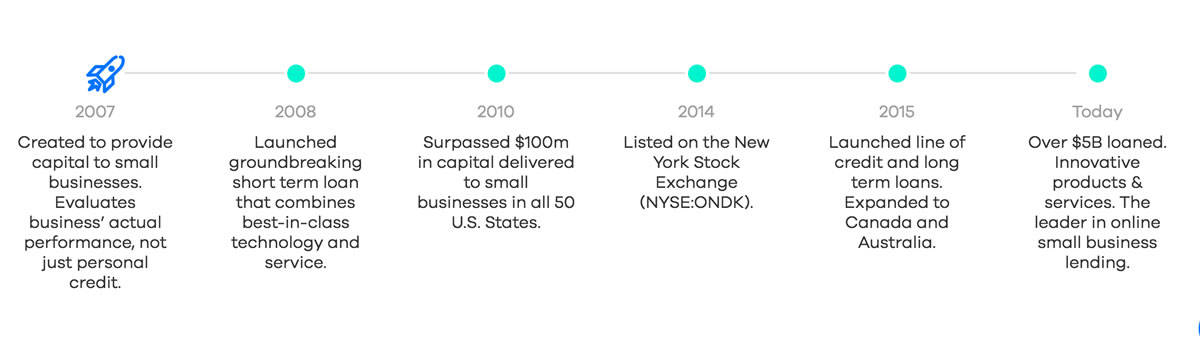

OnDeck was created to provide small businesses access to the capital they need. OnDeck can get you cash in as little as as one business day, for those months when you have a lean cash flow and you need to make payroll or pay the bills.

Small businesses can apply for loans ranging from $5000-$50,000 through their online application. You will receive notice if approved within minutes and could receive the funds in as little as one day.

8. Stripe

Stripe designed a top-notch API to give companies seamless payment solutions that are trusted and easy to use. Stripe believes the biggest problems with online payment systems are rooted in code, not finances. As a result, they are committed to robust and scalable integrations so you can get up and running in a matter of minutes. You will also get access to over 100 out-of-the-box features including Apple Pay, full data portability, and accounting integrations.

Stripe offers a “pay for only what you use” pricing plan at 2.9% + 30 cents.

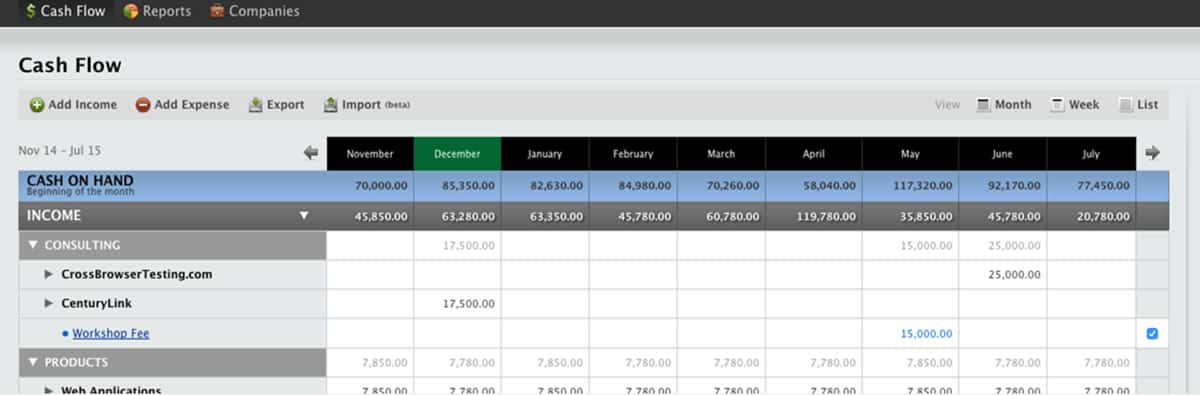

9. Pulse

Pulse is a cash flow management web application specifically designed for small businesses to help monitor expenses and make better business decisions through forecasting your cash flow. It is a great option for those of you who are less accounting-inclined, but need more than Excel to keep track of your finances.

The Pulse app helps visualize your day-to-day, weekly, and monthly cash flows through easy to understand graphics and charts. Another great aspect of the product is that is designed with collaboration in mind, allowing others on your team to easily make notes and edits.

Pulse offers a free 30-day trial. Pricing plans start at $14/month.

10. Google Docs

Google Docs offers templates that you can share and edit with other members of your team. You can search for templates that include cash-flow tools to find the right one for your startup. These templates can be used for sales forecasts, cash-flow forecasts, and to keep track of all your startup costs.

Nothing beats the fact that Google Docs is free and is a great resource for collaboration and communication with your team.

Start incorporating a few of these innovative financial apps to help manage your money and you will see the difference they can make to take your startup to the next level.

Proto.io lets anyone build mobile app prototypes that feel real. No coding or design skills required. Bring your ideas to life quickly! Sign up for a free 15-day trial of Proto.io today and get started on your next mobile app design.